Common End-of-Year Tax Client Considerations

Common End-of-Year Tax Client Considerations

The end of the year offers a chance not only for personal reflection but also for thoughtful tax planning. As portfolios shift with another strong market, investors are well served to consider if their portfolio is still on track—both from a risk and tax standpoint. Let’s consider a few key scenarios that can be tackled heading into year end.

Another Year, Another Stock That Did Better Than We Expected

Each year, a few standout stocks capture attention with spectacular returns—think names like Palantir, Oracle, Netflix, GE Aerospace, Uber, Johnson & Johnson, and Intel have outpaced the market this year. Holding one can feel like hitting the jackpot, but big winners often bring a hidden cost: concentration risk.

When one position grows too large, it can expose investors to outsized drawdowns and throw a portfolio off balance. After such strong gains, it may be time to rebalance—locking in success while keeping long-term goals on track and the right amount of risk in a portfolio.

Capital Gains Distributions and Mutual Fund Outflows

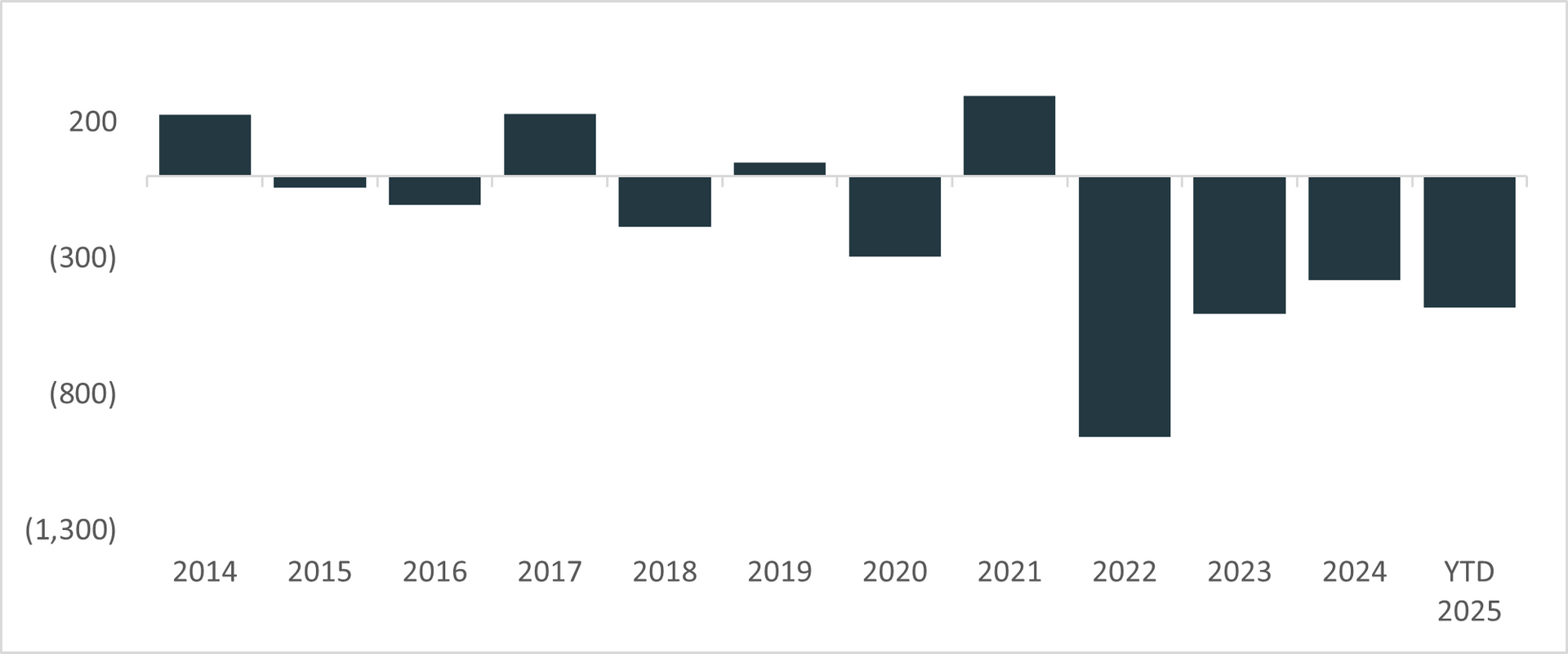

Mutual funds have many strengths, but tax efficiency isn’t one of them. They can distribute capital gains even when shareholders haven’t sold any shares, creating “phantom gains” and unexpected tax bills. A major driver of these gains is investor redemptions—when outflows force funds to sell holdings. Eight of the last ten years have seen net outflows from mutual funds in aggregate, and 2025 appears to be following suit.

While not every fund with outflows will make distributions, the risk rises as redemptions increase. If your mutual funds are seeing outflows, it may be wise to rebalance toward more tax-efficient options like ETFs before your mutual fund pays out capital gains.

Mutual Fund Net Flows by Year, in billions

Source: Morningstar Direct. Mutual funds include US open ended funds, excluding money market and feeder funds. YTD 2025 is as of September 30, 2025.

Tax-Management Best Practices

Year-end is prime time to put disciplined tax management into practice. Sometimes that means taking your medicine: not just avoiding taxes, but paying them. With U.S. markets at new highs, many investors have let their aversion to paying capital gains taxes let their portfolios drift far from their target allocation—often that means a portfolio has higher than intended risks. Realizing those gains now allows an investor to address those unintended risks.

Consider setting a “capital gains budget”—an amount you’re willing to realize this year and in 2026—to balance tax costs with the benefits of proper portfolio positioning. This approach helps investors stay focused on long-term objectives, plan for taxes before markets shift, and take advantage of strategies like tax-loss harvesting (selling losing positions to offset gains).

The trend in taxes and the investment landscape is one of increasingly complexity, meaning that working with knowledgeable financial advisors is increasingly valuable. The right guidance can help clients anticipate potential liabilities, make informed decisions, and stay on track toward their long-term financial goals.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Kestra Private Wealth Services, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Kestra Private Wealth Services, and Bluespring Wealth Partners, LLC, do not offer tax or legal advice.