Gratitude in the Markets: What Investors Can Be Thankful For

Gratitude in the Markets: What Investors Can Be Thankful For

November 18, 2025

Kara Murphy, CFA

Resilience in the Face of Tariffs

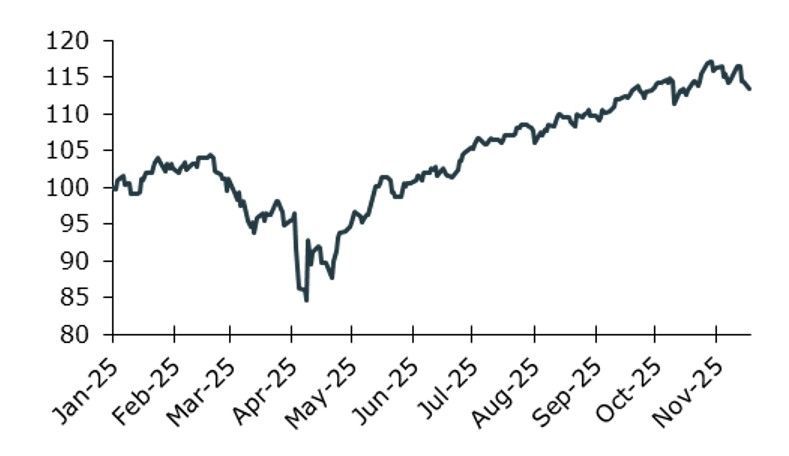

In April, the new Trump administration announced an extensive set of tariffs. In response to the sharp shift away from nearly 100 years of lower barriers to trade, stocks plummeted. In a five-day period from April 2 to April 8, the S&P 500 fell by more than 11%, extending losses that had started months earlier.

As the S&P 500 neared bear market territory, the administration paused a large share of the tariffs for 90 days. The pause prompted a rally in stocks even more virulent than the recent decline. The market has returned about 15% so far this year, which follows two consecutive years with returns over 20%.

S&P 500 Year-To-Date Performance (Jan 1 = 100)

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. Source: Kestra Investment Management with data from FactSet. Performance data as of November 17th, 2025.

Excellent Earnings Performance

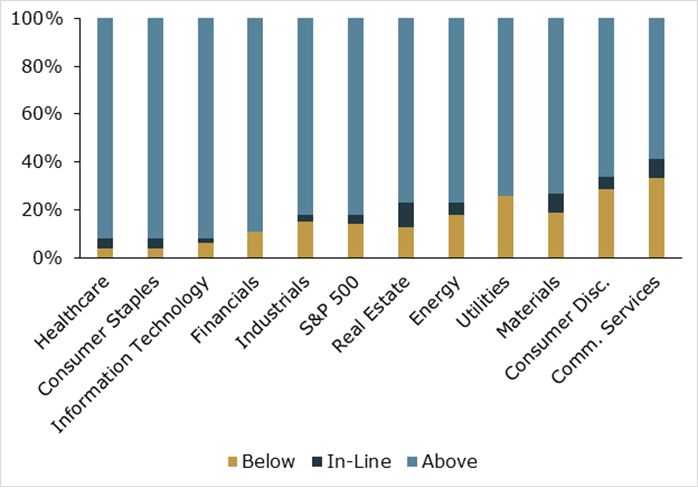

For the fourth consecutive quarter, companies in the S&P 500 are set to grow earnings by a double-digit percentage. With 92% of the index companies reporting results, the earnings growth rate for Q3 2025 is 13.1%. Despite a challenging macroeconomic backdrop, corporate profitability continues to provide the narrative to sustain the bull rally.

Earnings results across the market have beaten on both the top and bottom lines, with 82% of companies beating earnings per share (EPS) expectations and 76% surprising to the upside on revenue numbers. While the market may be expensive on a valuation basis, companies are doing their part to sustain lofty prices.

S&P 500 Earnings Results Relative to Estimates: Q3 2025

Past performance is not a reliable indicator of current or future results. Source: Kestra Investment Management with data from FactSet

Accommodative Monetary Policy

While the Federal Reserve has always been an important driver of economic growth and market, politics have kept it in the news more than usual this year. Uncharacteristically high levels of dissension on the committee, calls for Fed Chair Jerome Powell to be fired from the President, and a perceived lack of independence have led to increased scrutiny of the country’s central bank.

Outside of political influences, policymakers have had to balance a weakening labor market with persistent inflation. Despite these conflicting signals, the Fed lowered the Fed funds rate on two separate occasions to 3.75-4.00%. This decision will help with the cost of borrowing for both consumers and businesses and is expected to be followed by additional cuts.

Resilience, Profits, and Rate Cuts: A Full Plate of Gratitude

As we gather with loved ones this Thanksgiving, it’s worth remembering that investing isn’t just about numbers on a screen, it’s about building for the future. We’re committing to the things that matter most: security for our families, opportunities for future generations, and the freedom to live life on our terms.

Invest wisely, live richly and happy Thanksgiving,

Kara

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Kestra Private Wealth Services, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Kestra Private Wealth Services, and Bluespring Wealth Partners, LLC, do not offer tax or legal advice.