Tensions Rise, Oil Surges – Markets React

Tensions Rise, Oil Surges – Markets React

Introduction

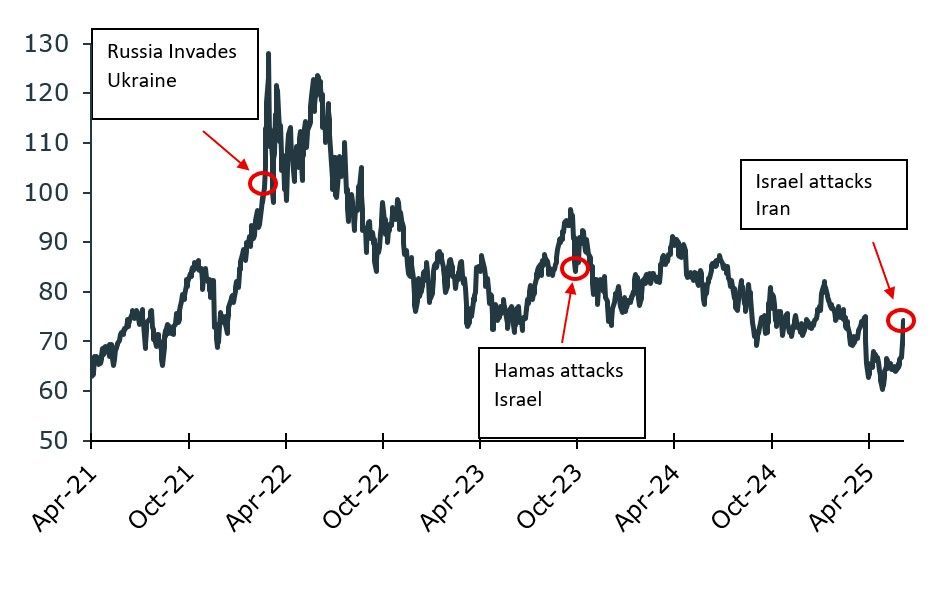

Last week, tensions in the Middle East escalated as Israel launched an assault on strategic Iranian infrastructure, high level officials within the Iranian regime, and individuals associated with Iran’s nuclear program. Consistent with similar events in the past, markets reacted quickly, with the largest impact seen in an abrupt rise in the price of oil.

The initial market response suggests that, at this point, the primary concern is centered around an oil supply disruption, implying to us that the conflict may remain contained to Israel and Iran. As the attacks between the two countries have intensified, however, concerns about a broader regional conflict involving other Arab states and the United States have increased but remain modest.

Initial Response

On Friday the 13th, global equity markets declined, with US, Japan, and China indices all experiencing a 1-day decline of around 1% and European equities declining by nearly 2%. The 10-year US treasury yield rose slightly as higher oil prices led to concerns about inflation. Yet, by the time of this writing, global equities had recovered some—or even all—of those losses, suggesting that markets are currently more sensitive to oil supply risks than to the possibility of wider conflict.

Following the attack on Thursday evening, WTI Crude Oil prices jumped by over 7%.

Brent Crude Oil Price ($/bbl)

Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. Note: views are from a U.S. dollar perspective. Source: Kestra Investment Management with data from FactSet. Time period from April 2021 – June 2025

Oil Market Implications

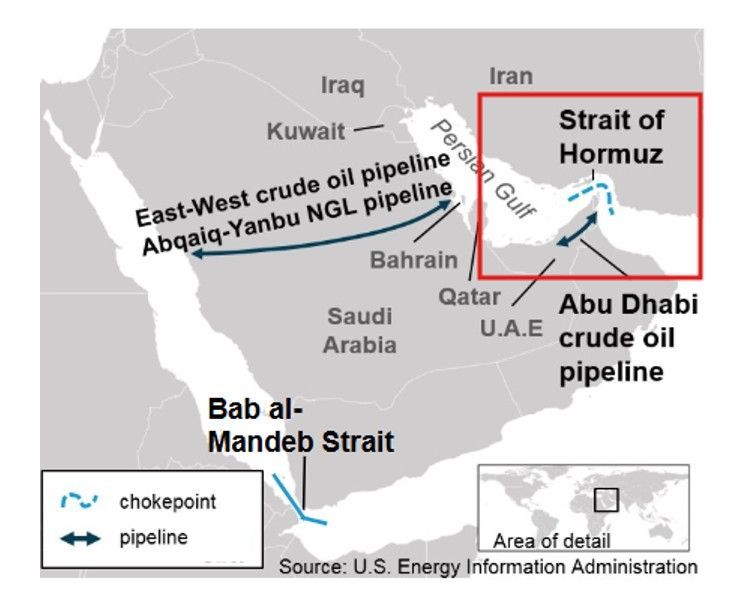

Given that Iran controls one of the main chokepoints for global energy trade - the Strait of Hormuz - a reduction in global oil supply is the primary risk to global financial markets. About a quarter of global energy trade, including oil and liquified natural gas, flows through the region. 76% of these energy products are destined for Asian countries including China, Japan, and South Korea.

Map of Strait of Hormuz and Surrounding Area

Source: U.S. Energy Information Administration

While it may seem like the impact on US energy supply would be limited, it’s important to note that in prior conflicts, Iran has threatened to shut down the Strait of Hormuz. This would cause significant disruption in global energy trade as suppliers are forced to re-route shipments and prompt Asian countries to seek supply from other regions, tightening the global energy market and indirectly impacting US prices.

If Iran were to shut down the shipping lane, doing so would also hurt its own exports. Additionally, pressure from Iran’s key trading partners who are reliant on the route for their energy imports means that a prolonged closure of the Strait of Hormuz is less likely. However, Iran does have a history of targeting oil tankers in the Strait of Hormuz during the conflict. As war risk is elevated in the region, the cost to insure these shipments rises dramatically, which in turn impacts the cost of oil through elevated shipping costs. Re-routing these shipments is possible in some cases, but costly. Finally, further supply constraints could result if Israel targets oil infrastructure. So far, some of Iranians oil infrastructure has been targeted, but not all.

In the short-term, a supply shock alone could reignite inflationary pressures, as declining oil prices have been one of the key drivers in bringing inflation down. In this case, higher oil prices and a possible decline in consumer spending could have a negative impact on corporate profit margins. The key questions at this point are whether the conflict remains brief and isolated to Israel and Iran, or whether a protracted regional battle erupts including the involvement of other countries, particularly the United States.

What’s Ahead

Whether the conflict remains brief and isolated to Iran and Israel, or if it becomes protracted with more countries becoming involved the result is likely to be similar. Volatility in oil, stock and bond markets has recently increased relative to the last two years, and given this conflict it is likely to continue to remain elevated. The difference is likely to be in the extent of this higher volatility: in a contained conflict, it is likely to be short-lived but will last longer if the conflict broadens out.

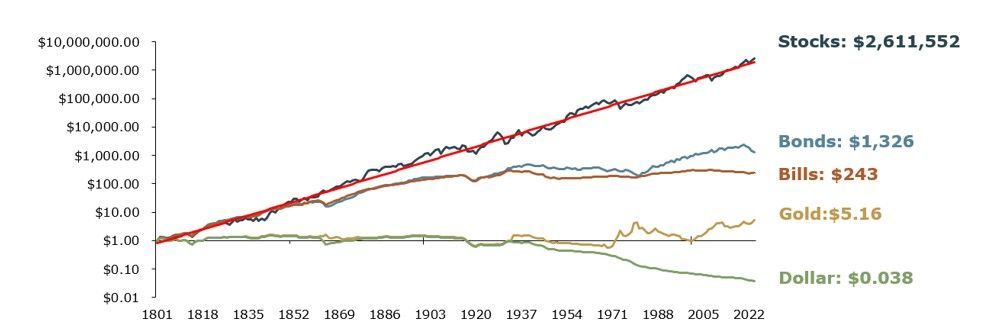

While every market shock is unique in some way, history tells us that markets eventually recover. Eventually, as conflicts pass or as companies and individuals adjust to a new normal, fundamentals reassert themselves. A diversified portfolio remains one of the best tools for weathering market volatility. Time has shown that diversification and maintaining a disciplined, long-term approach to investing are two of the best ways to grow wealth over time. We continue to emphasize global diversification across the portfolios that we manage and believe that it is too early to know whether a meaningful change to any portfolio’s overall risk allocation is warranted, but the situation requires ongoing monitoring.

Growth of $1, Adjusted for Inflation (1802-2024)

NOTE: Values are indexed to 1, log scale. Past performance is not a reliable indicator of current or future results. Indexes are unmanaged and not subject to fees. It is not possible to invest directly in an index. Source: Siegel, Jeremy, Stocks for the Long Run (2022), 6th edition with updates to 2024.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Kestra Private Wealth Services, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Kestra Private Wealth Services, and Bluespring Wealth Partners, LLC, do not offer tax or legal advice.